Tax learning

TELECOM Nancy is authorized to collect the balance of the apprenticeship tax for its digital engineering training. The commitment of businesses through the payment of their tax is essential for the school.

Thank you for your support !

To give us your support, connect to the SOLTéA platform from May 27 after activating your authorization on Net-Entreprises by following the step-by-step instructions available here .

Find TELECOM Nancy on SOLTéA with its UAI code: 054223 6M

We will not be able to know your payment in real time, so do not hesitate to inform us as soon as you have completed your procedures on SOLTéA.

Companies not subject to the apprenticeship tax, companies or individuals can make tax-free donations (in France) via a payment on the ID+ Lorraine Fondation website: https://fondation-idplus-lorraine.fr/projets/telecom-nancy /

APPRENTICESHIP TAX REFORM

Following Ordinance No. 2021-797 of June 23, 2021 relating to the recovery, allocation and control of employers’ contributions for the financing of vocational training and apprenticeship, the procedure for collecting and paying the balance of the Apprenticeship Tax has changed since 2023.

WHAT IS CHANGING?

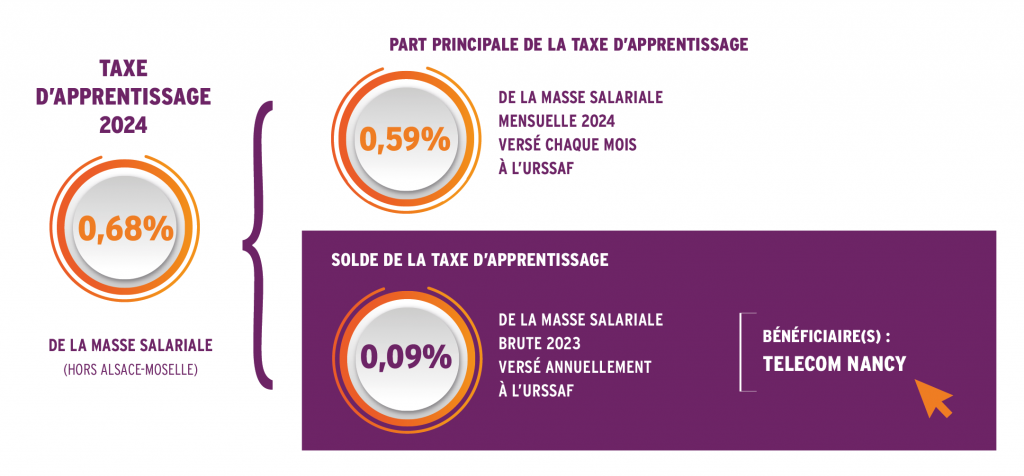

- The amount of the Balance (portion for which TELECOM Nancy is eligible) now corresponds to 0.09% of the payroll for year N-1

- Companies can no longer pay their balance directly to schools (neither check nor transfer)

- Payment is made in 2 stages:

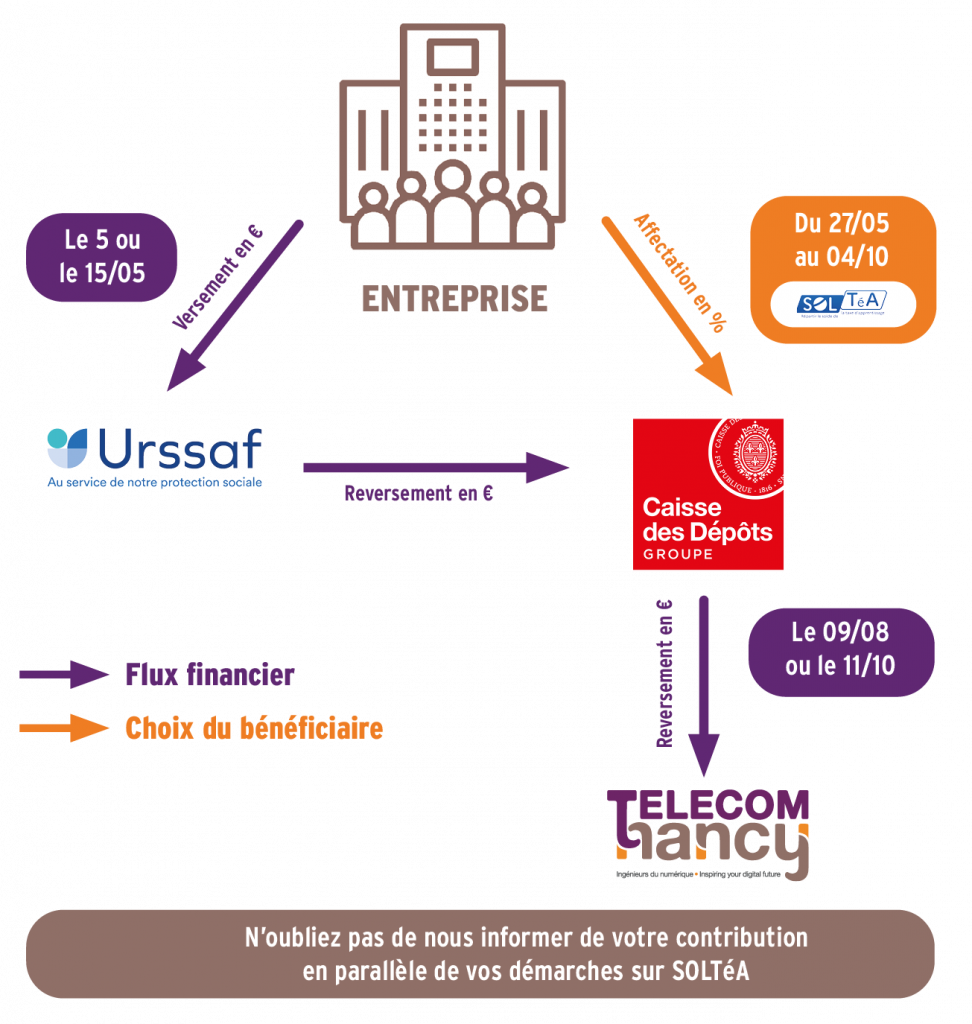

- May 5 or 15, 2024 (depending on the size of the company): payment of the balance to Urssaf in euros (according to the accounting elements communicated via the April DSN).

- From May 27 to October 4, 2024 inclusive: indication of the beneficiary on the SOLTéA platform with mention as a percentage of the allocated balance

Find us with our UAI code 0542236M

Indicate the percentage of the balance allocated to our school: Example: “80% for TELECOM Nancy” .

- Please note, if you do not take the step of choosing our school on the Soltéa platform, TELECOM Nancy will not receive anything from you even if you have paid the balance of your apprenticeship tax to Urssaf.

- The school will not be aware of your payment and will not receive it until August 9 or October 11, 2024, it is therefore essential to inform us of your steps in advance so that we can identify your support. Please complete our online form below or write to relex@telecomnancy.eu .

Faced with these developments, TELECOM Nancy supports you in your efforts. Do not hesitate to call on our External Relations service by contacting Anne-Laure Crugnola , head of corporate partnerships.

ON THE GOOD USE OF THE APPRENTICESHIP TAX

Over the last few years, the tax received by TELECOM Nancy has made it possible to invest in the acquisition of cutting-edge equipment and specific educational services for the benefit of our engineering students:

- two cyber-range training platforms for cyber security and the provision of dedicated rooms for the development of training in this area,

- an operational telemedicine platform,

- endoscopic tools, instrumented skull and eye-tracking infrastructure for digital learning of surgical procedures ,

- the development of a digital health Living Lab for home care,

- the establishment of an augmented reality educational platform,

- collaborative robots for “ Industry of the future ” training

- the development of collaborative work spaces ,

- the development of the soft skills of our students through our “Investing your active life” and “Team spirit” seminars.